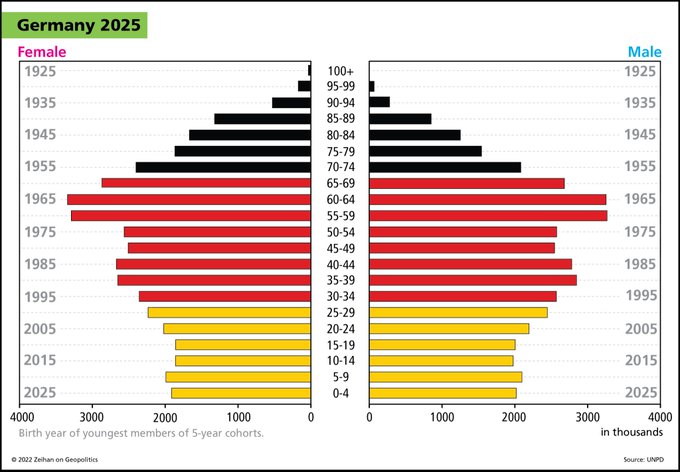

Demographics of Germany in 2025 (© Peter Zeihan)

Germany’s Demographic Outlook to 2040

Germany’s population has long been forecast to age and eventually shrink, and these projections are now becoming reality. As of 2025, the country has around 84 million inhabitants but virtually no growth is expected going forward. The Federal Statistical Office’s 14th coordinated population projection (baseline 2018) shows Germany’s population peaking by the mid-2020s and then plateauing or declining thereafter. Under moderate assumptions (medium fertility, continued high life expectancy improvement, and steady net immigration), Germany’s headcount will start to decrease by 2040 at the latest. Even optimistic scenarios (higher birth rates and high immigration) only manage to stabilize the population around current levels; more pessimistic scenarios foresee a clear decline. By 2040, Germany is likely to have slightly fewer people than today – on the order of 80–83 million – and the decline accelerates in subsequent decades (dropping toward ~74–75 million by 2060 under low-growth scenarios). In short, Germany in 2040 will not have more energy consumers than today, and quite possibly fewer. This contrasts with the post-war era’s assumption of ever-growing demand tied to population and economic expansion.

Equally important is the population’s changing age structure. Germany is greying: the massive mid-20th-century “baby boom” cohorts are moving into retirement, and younger generations are smaller. By the 2030s, the number of people over retirement age (67+) will swell to around 20 million (about 4 million more than in 2020). The over-80 population will surge in the 2040s as the boomers reach that age bracket. Consequently, the share of seniors in the populace will reach unprecedented levels. Projections indicate that by the 2040s roughly 25% of Germans will be 65 or older, up from 20% in 2020. This old-age dependency ratio (the ratio of seniors to working-age people) will strain the labor force and influence consumption patterns. An aging society tends to have different energy needs – for example, older adults spend more time at home, which can affect residential heating demand, and there may be fewer commuters but more demand for healthcare facility energy use. Thus, Germany faces not just a population decline but a demographic re-composition: fewer youth and workers, many more elderly.

These demographic shifts are expected to have direct consequences for energy demand. Population size and economic output have historically been key drivers of energy consumption. A shrinking, aging populace would, ceteris paribus, lower demand growth for residential electricity and heat as the number of households stabilizes or falls. Indeed, researchers warn that future energy planning must account for uncertain population trajectories – final energy demand in 2045 could vary by as much as 10–25% depending on demographic and economic growth trends. In other words, if Germany’s population declines faster or aging significantly dampens economic activity, total energy use could end up markedly lower than scenarios with stable population. Planners can no longer assume ever-increasing demand; instead, they must grapple with the possibility of declining or shifting demand. In the following sections, I break down Germany’s energy demand by sector to see where these demographic impacts will be most pronounced, and examine how the country’s energy mix and policies are adapting to this demographic context.Current Energy Demand by Sector

To understand how population changes might influence energy use, it is useful to first review Germany’s current energy demand landscape across the major sectors: residential (households), industrial, commercial (often termed “Gewerbe, Handel, Dienstleistungen” – trade, commerce, services), and transport. Each sector’s energy consumption profile is affected differently by demographics. In 2022, Germany’s total final energy consumption was about 8.2 exajoules (EJ)(roughly 2,270 terawatt-hours). This demand is distributed unevenly across sectors. The transport sector currently consumes the largest share, at about 2.5 EJ (around 30–31% of final energy), mainly due to fuel for cars, trucks, and other mobility. Industry and households each account for roughly a quarter of final energy use. In 2023, for example, industry used about 624 TWh and the residential sector 632 TWh (both ~2.25 EJ), each representing approximately 27–28% of Germany’s final energy consumption. The remaining demand (on the order of 13–15%) is attributed to the commercial, trade, and services sector, which consumed about 314 TWh (~1.13 EJ) in 2023. This sectoral breakdown has been relatively stable in recent years, with transport consistently the single biggest segment and the others not far behind in magnitude.

It is important to note not just the quantity of energy each sector uses, but how they use it – particularly distinguishing between electrical energy and heating demand, as these are most relevant to our analysis. In German households, the vast majority of energy consumption goes toward heating (space heating and hot water). Roughly 70% of final energy use in private households is for room heating. Despite improvements in home insulation and heating efficiency over the decades, rising living space per person and comfort expectations have kept residential heat demand substantial. Household electricity use (lighting, appliances, etc.) makes up the remainder of the residential sector’s consumption. In the commercial and services sector (offices, shops, public buildings), heating is also significant – about half of energy use in that sector is for space heat – while the other half is largely electricity for lighting, appliances, IT servers, cooling, and other equipment. Notably, the commercial sector has achieved a 25% drop in energy use between 2008 and 2023, in part due to energy efficiency upgrades like better insulation and a switch to LED lighting. This sector also has the highest relative electricity share of any sector, reflecting the power needs of modern commerce and communications.

The industrial sector’s energy demand is distinct from buildings: about two-thirds of industrial final energy is used for process heat (high-temperature heat for chemical reactions, metallurgy, etc.), typically supplied by burning fossil fuels or using steam. Roughly one-quarter of industry’s energy goes to mechanical energy, i.e. running machines and motors – a category dominated by electricity use. Only a small fraction of industrial energy is for facility heating or cooling of spaces. These proportions mean that industry heavily relies on fuels (like natural gas, coal, and increasingly electricity) for thermal processes, and electricity for machine drive, but demographic shifts might influence industrial energy indirectly via economic output rather than household behavior.

Finally, the transport sector in Germany remains dominated by oil products (gasoline, diesel, kerosene) accounting for over 90% of transport final energy. Transport energy demand historically grew until about 2018, then dipped during the 2020 COVID lockdown, and partially rebounded, though as of 2023 it remained below pre-pandemic highs. Electrification of transport is just beginning – as of 2023, electricity was a bit above 2% of transport final energy – but is set to increase with the rise of electric vehicles. Transport is the sector perhaps least directly tied to population size (it depends more on vehicle stock and travel behavior), but fewer people (especially fewer working-age commuters) could moderate growth in transport energy demand as well.

Impact of Population Decline on Energy Demand by 2040

Residential Sector: A shrinking population implies fewer total households in the long run – although the relationship is nuanced by household size. Germany’s average household size has been decreasing, and more people living alone (especially many widowed elderly) can actually increase the number of households per capita. In the near term, the total number of households may hold steady even as population peaks, because smaller households proliferate. However, by the 2030s and 2040s, if the population falls, we expect a decline in occupied dwellings as well. Fewer occupied homes will tend to reduce aggregate residential energy demand, especially for heating. Indeed, a major driver of residential heating demand is the volume of living space that needs to be heated nationwide. If population drops, some housing units may be left vacant or taken out of use, reducing total heated floor area. A government-sponsored analysis notes that moderating growth (or enabling reduction) in floor area can aid energy savings – for example, repurposing or downsizing under-used buildings.

That said, population aging may counteract some of the demand reduction from fewer households. Older individuals often have different energy consumption patterns than younger ones. Studies have found that elderly occupants tend to prefer higher indoor temperatures, leading to greater heating energy use per person. An aging population spending more time at home can push up per-capita residential heating needs. For instance, a quantitative study in Slovenia (an EU country with similar aging trends) showed that when adjusting energy models to account for the elderly’s behavior (higher thermostat set-points, etc.), total residential heating demand projections increased by about 7% by mid-century relative to a scenario with the same population but younger behavior. In Germany, many retirees live in older, less-insulated houses and may heat them to comfortable levels throughout the day. Thus, the composition of households (more single seniors, fewer young families) could lead to higher energy use per capita, partially offsetting the reduction in the number of people. On balance, Germany’s residential energy demand is likely to decline modestly by 2040 in absolute terms due to population loss, but not as steeply as the population decline in percentage terms – because aging may raise usage per person and because of inertia in housing stock trends. Indeed, long-term data show Germany’s household energy use has not fallen dramatically over decades even with efficiency gains, as larger dwellings and increased appliance ownership offset improvements.

In terms of electrical energy, demographic effects on residential electricity consumption include potentially lower usage of certain appliances (fewer young families could mean less use of electronics, or maybe not – seniors also use TVs, medical devices, etc.), and possibly peak load timing changes (more people at home during daytime can flatten demand curves). There could be fewer total consumer electronics and IT devices in use if the population contracts, slightly easing electricity demand. However, one must weigh this against the counter-trend of electrification: even as population declines, Germany is promoting heat pumps to replace oil/gas heaters in homes and EVs to replace gasoline cars. Heat pumps will add to residential electricity demand (while cutting fuel demand), and an aging society could still adopt these technologies, especially as new laws essentially mandate a transition to cleaner heating systems in the coming two decades. Thus, residential electricity demand might remain stable or even grow to 2040 despite fewer people, due to these electrification policies for climate goals. Meanwhile, heating demand (which currently relies heavily on natural gas and oil in Germany’s 40 million homes) may decline in fossil energy terms both from population decline and energy-efficiency renovations, but some of that heating demand will shift to the electric grid via heat pumps. The net outcome could be a moderate decline in total final energy use by households, with a smaller portion coming from fossil fuels and a larger portion from electricity or district heat.

Demographic change affects these sectors primarily through economic channels. A smaller working-age population can constrain economic growth and industrial output. Germany is already experiencing labor shortages in industries including energy and manufacturing as baby boomers retire. If the population (and labor force) contract by the 2030s, industrial production could slow or certain energy-intensive industries might relocate or scale down. Indeed, projections by research consortia suggest that by 2040 the industrial sector’s energy consumption in Europe could be 20–45% lower than today under deep decarbonization pathways that coincidentally involve slower growth and efficiency gains. Germany’s own heavy industry has recently faced headwinds from high energy prices and is adapting by investing in efficiency and higher-value products rather than volume growth. Thus, industrial energy demand in Germany may see only modest growth or even a decline by 2040, not so much because of population decline per se but due to anemic economic/demand growth and aggressive energy-saving measures. An aging population can contribute to this stagnation by reducing domestic consumption of goods and by tightening the labor supply for factories.

For the commercial (services) sector, population decline might reduce demand for some services (for example, fewer retail shoppers, students, etc.), potentially leading to consolidation of commercial floor space. If towns and regions face depopulation (a likely scenario in some rural parts of Germany, there may be excess building stock – offices, schools, shops – that no longer need heating and lighting, which could cut energy use locally. On the other hand, certain service sectors like healthcare will see higher demand due to aging (more hospitals, care homes operating at full capacity), which could increase energy use in those subsectors. Overall, however, a shrinking population tends to correlate with lower commercial energy demand. We have already observed a downward trend in Germany’s commercial/service energy consumption, driven by efficiency and perhaps saturating demand. By 2040, the tertiary sector’s energy use is expected to continue to gradually decline or at least not rise, aligning with both demographic and efficiency trends.

One special note is the public and infrastructure energy use: some energy demand (like street lighting, water supply, data centers, etc.) is not directly tied to population in a linear way. For example, water utilities in parts of Germany have had to manage lower demand and even flush pipes to avoid stagnation in shrinking towns. Similarly, the energy used for public lighting or transport networks might not fall proportionally with population, potentially leading to higher per-capita energy overheads in depopulating regions. Policymakers may need to rationalize infrastructure in response – an issue discussed later.

Transport Sector: Fewer people usually means fewer drivers and potentially fewer vehicles on the road, all else equal. Population decline would thus put downward pressure on transport fuel demand, especially after 2030 as Germany’s population aging accelerates (older people travel less for work, and total population falls). The European Scientific Advisory Board on Climate notes that transport is projected to see the largest reduction in energy consumption by 2040 (30–60% less than current) under climate policy pathways, outpacing reductions in industry or buildings. While much of that is due to efficiency improvements and modal shifts, demographics plays a supportive role: an aging Europe will likely travel less by private car on average. In Germany, we might expect a peak in car ownership followed by a slow decline as the population peaks and new generations are smaller. Already, high fuel prices and environmental awareness have curbed some transport energy use, with 2022 seeing transport energy still well below pre-2020 levels. By 2040, widespread electric vehicle adoption will have dramatically reduced oil consumption in transport (each EV uses considerably less total energy per km than a combustion car). So, between fewer people traveling and more efficient vehicles, transport final energy demand is poised to drop significantly. However, one should note that while total energy for transport may drop, electricity demand for transport will rise as EVs and electrified rail/bus systems expand. This is part of the overall trend: electrification often shifts energy demand from fuels to the electric grid without changing the population driver. Germany’s transport electrification is slightly behind some neighbors but is picking up speed – e.g. EVs made up a growing share of new car sales in the 2020s, and policy is aligned with the EU goal to phase out new combustion car sales by 2035. Thus, by 2040, we can expect a noticeable chunk of Germany’s electricity consumption to be for charging vehicles, partially offsetting declines in petrol and diesel use.

In summary, population decline and aging will likely yield a moderate reduction in Germany’s overall final energy demand by 2040, mainly through the residential, commercial, and transport sectors. The industrial sector’s energy use will hinge on economic factors but is not likely to surge given workforce constraints and efficiency improvements. Quantitatively, scenarios suggest Germany’s final energy consumption could be on a path to fall by perhaps 10–20% by 2040 from today’s levels if demographic and efficiency trends align (in line with EU-wide projections of ~20–40% declines by 2040). Indeed, Europe as a whole expects flat or declining energy use over the next two decades: the EU’s impact assessment for 2040 shows final energy use dropping by about one-fifth to one-third under various climate policy scenarios. Germany, being a mature economy with negligible population growth, fits this profile. Notably, Germany’s electricity demand might buck the trend and increase despite population decline – reaching perhaps around 700–750 TWh by 2040 (up from ~550 TWh in 2020) if strong electrification of transport, heating, and industry occurs – but this rise is due to fuel-switching (from oil/gas to electric) rather than more people or bigger economy. Thus, the composition of energy demand will shift even as the total demand growth is subdued. The next section examines how Germany’s energy mix is adapting in response to these developments.

Adapting Germany’s Energy Mix to Demographic and Demand Changes

Germany’s energy mix – the breakdown of energy sources supplying its needs – is undergoing a historic transformation (“Energiewende”) driven by climate policy, technology, and now also by the realities of a stagnating domestic market. In the past, rising energy demand from a growing population and economy was met by expanding fossil fuel use (coal, then oil and gas) and a now-phased-out nuclear program. Today, however, Germany aims to reduce total energy consumption and dramatically increase the share of renewables. Demographic change both enables and necessitates adjustments in the energy supply strategy.

On the one hand, slower demand growth due to population decline makes it easier for renewable energy expansion to outpace demand. Germany no longer needs to build power generation just to keep up with surging consumption; instead, it can focus on replacing existing fossil generation. Indeed, Germany’s power consumption has been roughly flat or declining in recent years (2022 power demand was ~3% lower than the previous year, hitting levels last seen two decades ago). This “demand plateau” has allowed renewable energy to rapidly gain share in the electricity mix. In 2023, Germany set a record with about 56% of its gross electricity produced from renewables, and coal-fired generation dropped to the lowest levels in decades. A combination of aggressive policy support and temporarily lower consumption (partly due to a mild recession) pushed the renewables share higher. By 2024, renewables (wind, solar, biomass, hydro) accounted for roughly 58% of electricity production, while coal and gas made up the rest. The government has targets to reach 80% renewable power by 2030 and near-100% by 2035–2040, in line with its climate neutrality by 2045 goal. With flat or falling electricity demand growth (from demographics and efficiency), achieving these targets is more feasible – each new wind turbine or solar farm contributes to displacing fossil generation rather than feeding new consumption. In essence, the demographic context gives Germany a bit of breathing room to pursue decarbonization without worrying about meeting ever-increasing peak loads.

On the other hand, an aging, shrinking population poses challenges for the energy sector’s economics and infrastructure utilization. If total energy demand declines, some legacy infrastructure may become under-used. For example, Germany’s expansive natural gas pipeline network was built for higher gas consumption that may not materialize in 2040 due to both population decline and fuel switching. Gas utilities could face a shrinking customer base, which raises unit costs for remaining consumers and could necessitate restructuring (this dynamic has been seen in East German regions where population loss after reunification led to oversized utilities). Similarly, the power grid must adapt: certain regions of Germany (especially rural East and some depopulating industrial towns) will see lower loads, while urban centers with stable or growing populations (buoyed by migration) may concentrate demand. The energy mix needs to be flexible to these spatial shifts. Germany’s grid development plans already consider scenarios of demand concentration in urban/industrial hubs and the need to transmit renewable power from windy and sunny areas to those consumption centers. With fewer overall consumers, maintaining grid infrastructure might require policy support or consolidation of networks in areas that lose many inhabitants (to avoid stranded assets).

Another adaptation in the energy mix relates to heating: as noted, most heating in Germany has relied on oil and natural gas. The government’s policy response – partly motivated by climate goals and partly by energy security after the 2022 Russian gas cutoff – is to transition heating to renewables (electric heat pumps, solar thermal, biomass, and district heating) over the next two decades. A demographic lens on this transition shows some advantages and hurdles. The advantage is that with fewer new households forming, there is less growth in heating demand – making it easier to supply heat with renewables. Moreover, many old heating systems will reach end-of-life in the 2020s/30s (Germany’s heating system stock is aging, with millions of boilers due for replacement). This coincides with the aging of homeowners; policies will need to incentivize or assist elderly homeowners to replace fossil boilers with heat pumps, for instance. The hurdle is that an older population may be less able to afford or manage the upfront investment for new heating tech without support. Policymakers are indeed crafting subsidies and mandates to ensure adoption (e.g. a planned ban on new fossil-fuel boilers from 2024 onward, with exceptions and support). If executed well, by 2040 Germany’s heating energy mix will have shifted significantly: electric heat pumps powered by renewable electricity could provide a large share of residential heat, and district heating systems (some using industrial waste heat or biomass) will cover more buildings. This means that while total heating fuel demand might drop (due to efficiency and fewer buildings in use), the electricity portion of the heating mix expands. Germany anticipates a surge in power demand from heat pumps – one reason it is racing to add green electricity generation. Researchers stress that electrification of heat and transport must be “at the centre” of transition strategies regardless of demographic uncertainties, with power demand in Germany potentially roughly doubling by 2045 as a result. In short, the energy mix is shifting from a diversified fossil portfolio to one dominated by electricity (from renewables) and some residual fuels for industry and backup.

Economically, energy companies and utilities are adjusting their strategies. With a domestic market that may not grow in volume, electricity providers are focusing on offering new services (like flexible demand management, electric mobility services, etc.) and on exporting power to neighbors when surplus is available. Germany has increasingly become a power exporter on windy/sunny days. By 2040, if domestic demand is lower than generation potential, Germany could consistently export clean electricity to regions with higher demand (like southern Europe) – effectively turning demographic decline into an opportunity to be a net energy exporter at times. However, this requires grid expansions and market integration across Europe. The European context is important: Europe’s overall population is nearly stagnant (the EU-27 will peak around 526 million in the 2040s and then slowly decline), so many countries share Germany’s demographic trajectory. Europe as a whole is targeting large reductions in fossil fuel use (a 75% cut in primary fossil energy by 2040, according to EU modeling)and improvements in efficiency such that final energy demand could be 20–40% lower in 2040 than today. This means Germany’s neighbors likewise may have lower energy demand, potentially easing cross-border energy trade constraints. In a scenario where all of Europe’s energy demand is shrinking, there could be overcapacity in some generation assets, putting economic pressure on utilities – another reason the energy mix is being steered towards flexible, low-marginal-cost renewables rather than large baseload plants.

Finally, the energy mix must adapt to the reality of an older workforce and investment climate. An aging population can lead to labor shortages in highly skilled fields like engineering and construction, which are crucial for building wind farms, power lines, and other energy infrastructure. Germany is actively recruiting workers (including through immigration reforms) to staff its energy transition projects, recognizing that without enough manpower, the shift in energy mix could stall. Additionally, an older society might be more risk-averse in investment, and utilities might see flatter demand and thus lower returns on investment in traditional expansion. This is pushing innovation in business models – for example, power companies investing in energy efficiency services (helping an aging clientele use less energy) and smart grid technologies, rather than simply selling more kWh. Overall, Germany’s energy mix in 2040 will likely be much greener and more electricity-centric than today’s, thanks to policy drivers, and the demographic context – lower demand growth – will have smoothed the transition in some ways (easier to meet targets) while complicating others (financial and workforce challenges).

Economic and Policy Implications

The intersection of demographic decline and the energy sector carries significant economic and policy implications. First, there is a macroeconomic impact: a smaller, older population means slower GDP growth, which can translate to slower growth in energy demand and potentially lower industrial activity. Energy companies must adjust expectations for future sales volumes. Utilities that once banked on growing electricity or gas consumption must plan for a plateau or decline in residential and commercial sales. For instance, Germany’s per-capita electricity use actually fell in 2023 to about 5,465 kWh, and total energy consumption dropped 9% – a combination of efficiency, high prices, and mild weather, but also part of a longer trend. If such trends continue, utilities might face overcapacity in power generation. Already, Germany’s wholesale electricity prices turned negative at times due to excess renewable generation relative to demand. With even fewer consumers by 2040, managing supply-demand balance will be critical. This may spur policies to export surplus energy or to accelerate the retirement of outdated power plants (avoiding oversupply). Economic planning in the energy sector is thus shifting from growth to optimization and resilience.

A notable economic concern is the potential for higher per-customer costs in energy infrastructure. Many energy system costs (grid maintenance, pipeline upkeep, etc.) are fixed – they do not fall quickly when the number of users falls. If, say, a rural region loses 20% of its population, the electricity distribution network still must cover the same area, but with fewer ratepayers to shoulder the costs. This can lead to increased tariffs unless subsidies or network right-sizing measures are taken. Germany may need policy interventions to prevent demographic change from causing unequal energy costs. One idea is to consolidate or modernize infrastructure in shrinking areas – e.g., retiring under-used gas networks if a whole town moves to electric heating, thereby avoiding maintaining two parallel energy systems (gas and electric) for a dwindling customer base. The OECD has emphasized that Germany should leverage such opportunities to improve efficiency while ensuring affordable energy access in all regions.

Another implication is on the labor market and investment in the energy industry. As previously mentioned, an aging workforce could slow down the build-out of new energy projects. Skilled labor shortages are already reported in renewables installation, grid construction, and skilled trades like HVAC technicians. The government will likely expand training programs and facilitate immigration of qualified workers to mitigate this. Failure to do so could jeopardize the infrastructure upgrades needed for the future energy system. Moreover, an older population might have different risk appetites for infrastructure investments – for example, public opposition to new transmission lines or wind farms might increase in areas with older demographics that prioritize landscape preservation. However, surveys show older Germans are also concerned about climate change and support the Energiewende strongly, so policy must balance engagement with these communities to ensure projects can proceed.

In terms of policy planning, Germany must incorporate demographic scenarios into its energy models and strategies. The Helmholtz Energy Alliance researchers explicitly call for considering uncertain population and GDP growth in energy infrastructure planning. This means developing flexible, adaptive policies rather than one-size-fits-all. For instance, if population decline accelerates, Germany might not need to subsidize as much new power capacity, but it might need to invest more in decommissioning or repurposing existing assets. Conversely, if higher immigration keeps the population flat, policies should be ready to accommodate slightly higher demand (though still efficient). One concrete policy area impacted by demographics is energy efficiency and retrofitting: with many buildings occupied by elderly owners, there is a need for innovative financing (like on-bill financing or public grants) to retrofit homes with insulation, heat pumps, and smart controls. This accomplishes two goals: adapting homes for an aging populace (comfort, lower bills) and cutting overall heating demand in line with the smaller future population. The government’s building energy law updates and incentives for heat pumps are steps in this direction.

The energy sector’s financial health is another consideration. If electricity demand growth comes mostly from new sources (EVs, heat pumps) while traditional consumption stagnates, utilities will change revenue streams. They may push into new business models – for example, selling “heat as a service” (where a company installs a heat pump and the homeowner pays a monthly fee, outsourcing the hassle). They might also focus on export markets or on providing balancing and storage as the domestic market becomes saturated with renewables. In essence, German energy firms might increasingly become exporters of clean energy technology and services, given that domestically the pie is not growing much. This could be a positive outcome – leveraging Germany’s early move into renewables to capture international market share, supported by policy (as seen by initiatives to fund green hydrogen and e-fuels that could be exported if local demand is weak).

From a consumer perspective, population aging raises the importance of energy affordability and social policy. Many retirees live on fixed incomes, so even if energy demand per capita falls, high energy prices can be a burden. Policymakers will need to ensure that the energy transition (e.g., carbon pricing that makes fossil fuels more expensive) does not unduly burden the shrinking working-age population or the growing retiree population. Mechanisms like revenue recycling from carbon taxes into household rebates, or targeted support for low-income elderly households to improve efficiency, will be key. The German government’s recent moves to cap electricity prices for heavy industry and provide heating cost relief during the gas crisis indicate an awareness of these socioeconomic impacts. By 2040, with potentially fewer people to fund the welfare system, energy policies might be tightly integrated with social policies – for instance, funding building retrofits as a way to reduce household energy bills and thus relieve pensioners’ cost pressures.

Lastly, we should consider broader European policy implications. Germany is not alone in facing demographic decline; many European countries (especially in Eastern and Southern Europe) are experiencing even faster population drops. The EU as a whole could see about 30 million fewer people by the end of the century. This has led the EU to emphasize energy efficiency – essentially doing more with less. The EU’s 2024 Climate Target plan assumes member states must achieve faster reductions in final energy use to meet climate goals, given the stagnant population. There is an opportunity for Germany to lead by example in policies that align demographic and climate objectives: shrinking the total energy throughput of the economy while maintaining economic output and quality of life. This includes investing in automation and productivity (to counter labor shortages) which can also improve energy productivity (more GDP per unit of energy). Germany’s Council of Economic Experts has discussed how demographic aging could drag down long-run growth without countermeasures – energy policy can contribute to those countermeasures by reducing energy costs through efficiency and ensuring energy supply doesn’t become a limiting factor for growth.

Recommendations for Adapting Energy Policy to Demographic Change

Germany’s energy policy through 2040 should explicitly integrate demographic realities to ensure a smooth and equitable energy transition. Based on the analysis above, I offer the following key recommendations:

- 1. Incorporate Demographic Scenarios into Energy Planning: Government energy outlooks and infrastructure plans (for electricity, gas, heat networks) should use multiple population scenarios (high, medium, low) when forecasting demand. This will prevent overbuilding or underutilization. For example, grid expansion plans should consider a scenario where electricity demand is, say, 15% lower in 2040 due to demographic and efficiency factors, and ensure investments are robust under that outcome. Researchers have noted that final energy and capacity requirements could vary by up to 25% by 2045 depending on population/GDP trends, so plans must be flexible. The Energy Ministry can task its scenario modeling groups (like DENA or Prognos) to include demographic sensitivity analysis in all future projections.

- 2. Accelerate Energy Efficiency and Retrofit Programs Focused on Buildings: An aging, declining population means many existing buildings will persist as the core of housing (rather than extensive new construction). It is imperative to retrofit this building stock for efficiency. I recommend scaling up programs that insulate homes, install modern windows, and upgrade heating systems – especially targeting homes owned by seniors. One idea is a “Rehab and Age-in-Place” initiative: provide combined grants or low-interest loans for energy retrofit and age-friendly modifications (like stairlifts), so that elderly residents can both save energy and comfortably remain in their homes longer. Since space heating is 70% of household energy use, cutting heating demand through insulation and efficient heat pumps yields big gains. Efficiency gains in buildings directly offset the impact of any increased per-capita heating from older occupants. The goal should be to reduce total heating energy use by a higher percentage than the population decline, to meet climate targets and avoid waste in under-occupied buildings. The European “Renovation Wave” initiative and Germany’s CO₂ Building Renovation Program should be aligned with demographic data – e.g., prioritizing regions with many older, energy-inefficient homes and population outflow.

- 3. Right-Size Infrastructure and Avoid Overcapacity: Germany should proactively plan for consolidation of energy infrastructure in regions with significant population loss. This could mean phasing out parts of the natural gas grid where building density no longer justifies it (especially as electrification of heat proceeds). It also means designing the electricity distribution grid to be modular – so that if a town shrinks, some local feeders can be decommissioned or merged without compromising reliability. The government can provide utilities with guidelines and financial support for “smart decommissioning.” As an example, if a village’s population drops below a threshold, perhaps support is given to transition remaining customers to all-electric and retire the gas network, thus saving maintenance costs long-term. Such decisions must involve community consultation and ensure no one is left without service. Additionally, when building new infrastructure, anticipate lower long-term utilization – for instance, build somewhat smaller combined-heat-and-power plants or district heating loops if projections show the customer base will dwindle by mid-century.

- 4. Promote Load Flexibility and Smart Grids: With an older population, daily patterns of energy use will shift (more midday home occupancy, less evening peak from commuters). Energy policy should invest in smart grid technologies and demand response programs that take advantage of this. For instance, encourage retirees to enroll in demand response programs that, say, run their heat pump or water heater at mid-day when solar power is abundant and turn down during peak times – with automation making it seamless. This can flatten peaks and reduce the need for excess generation capacity. It also gives seniors opportunities to save money by adapting their usage (with proper support and user-friendly tech). Overall, a more flexible demand profile will help integrate renewables, which aligns with the supply mix changes. The electrification of heating and transport can actually become an asset if managed smartly (charging EVs or heating water when there’s surplus green power). The policy recommendation is to provide incentives for smart appliances, on-site storage, and time-of-use tariffs that reflect the new consumption patterns in an aging society.

- 5. Address Labor Gaps with Training and Immigration: To ensure the energy transition doesn’t stall due to workforce issues, the government should expand vocational training in electrical, mechanical, and construction trades related to energy (for young people) and facilitate immigration for skilled workers in the energy sector. As the IMF and others have pointed out, Germany’s labor force will shrink more than any G7 country’s in the next five years without intervention. Energy policy isn’t just about technology; it’s also about people to implement it. Creating apprenticeships focused on renewable energy installation for domestic and foreign trainees, and simplifying qualification recognition for foreign engineers and technicians, are steps that can help. Additionally, retaining older workers longer in the energy workforce through flexible hours or consulting roles can ease knowledge transfer. The success of Germany’s climate and energy goals by 2040 will depend on having “all hands on deck” despite demographic headwinds.

- 6. Ensure Energy Remains Affordable and Equitably Priced: With fewer working-age people supporting societal costs, protecting vulnerable groups (like low-income seniors) from high energy bills is crucial. Germany should continue and expand schemes such as progressive electricity tariffs or targeted “energy allowances” for pensioners. For example, a baseline amount of electricity sufficient for basic needs could be provided at a discounted rate for households of retirees, helping those who are home all day (and possibly using more power for medical devices, cooling in summer, etc.). Funding for such measures could come from carbon pricing revenues or efficiency program savings. Moreover, regulatory oversight might be needed to prevent network charges from rising disproportionately in rural depopulated areas – possibly by spreading costs more broadly or subsidizing networks that face customer losses (a kind of solidarity mechanism within the country or EU). Keeping energy affordable will maintain public support for the energy transition in an aging society, as older voters especially will demand cost stability.

- 7. Leverage Surplus Renewable Capacity for Economic Benefit: If domestic demand weakens, turn potential excess renewable generation into an economic opportunity. Germany can produce green hydrogen or synthetic fuels with surplus renewable power and export these fuels to countries with higher demand, or use them as industrial feedstock. This way, investments in renewables continue to be useful even if local electricity usage stagnates. It also secures Germany’s role as a leader in renewable tech. Essentially, don’t let power plants sit idle – find alternative markets. Germany’s plan to become a hydrogen hub in Europe aligns with this; by 2040, domestic electricity demand might not use all the offshore wind power Germany plans to build, so converting it to hydrogen for steel factories or export can keep the industry thriving. Policies to subsidize electrolyzers and storage when there’s oversupply will help balance the grid and create export commodities.

- 8. Enhance Regional Transition Assistance: Demographic decline will hit some regions harder (e.g., parts of East Germany, shrinking rural districts) while others (big cities like Munich, Hamburg or regions with higher immigration) remain stable. Energy policy should be tailored regionally. The federal government, possibly in coordination with EU regional development funds, should support local energy initiatives in shrinking regions – for instance, grants for community energy projects that utilize local renewable resources to supply a smaller population efficiently. This not only provides appropriate-scale energy solutions but can stimulate local economies with new activities (installation, maintenance jobs) even as other sectors shrink. Conversely, in growing urban areas, ensure grid and generation investments keep up to avoid shortages. A one-size policy will not fit all; differentiation is key.

- 9. Monitor and Research Consumption Behavior of an Aging Population: There is still uncertainty about exactly how an older German society will use energy – for example, will smart home tech and cultural shifts lead seniors in 2040 to be more energy-saving than today’s seniors? Ongoing research is needed to refine our understanding. The government should fund longitudinal studies on household energy use by age group, to detect changes and update policies accordingly. If, say, it’s observed that single seniors are heating entire large homes inefficiently, policies might encourage homesharing or downsizing to reduce wasted space. Or if many elderly households adopt solar panels and home batteries (which is plausible given dropping costs), that could significantly change net demand. Keeping a pulse on these trends will allow mid-course corrections in policy.

- 10. Foster European Collaboration on Demography and Energy: Finally, Germany should work with the EU on joint approaches to the twin challenges of aging and decarbonization. This could include sharing best practices on managing infrastructure in shrinking regions, coordinating cross-border grid usage as demand patterns change, and perhaps adjusting EU funding formulas (which often depend on population) to ensure countries can finance energy projects even as their population base declines. Europe’s climate strategies already assume a degree of population stagnation; making it an explicit part of energy dialogues (for instance, at EU energy ministers meetings) will help normalize the idea that less can be more – i.e., success is not in consuming more energy, but in improving quality of life with less resource use.

Germany’s population decline and aging through 2040 will significantly shape its electrical and heating energy landscape. The evidence surveyed – from official demographic projections to energy consumption data by sector – indicates that Germany is likely to experience at most modest energy demand growth, and quite possibly a decline in total final energy use, over the next two decades. Residential and commercial energy needs are set to ease as the number of inhabitants and households falls, even though aging may alter consumption patterns in complex ways. Industrial energy demand will depend on economic adaptation to a smaller workforce, while transport energy use should decline with fewer people and the shift to efficient electric mobility. These changes unfold against the backdrop of Germany’s ambitious Energiewende, which by 2040 will have fundamentally transformed the energy mix toward renewables and electrification.

The interplay of demographics and energy is already evident. In 2022–2023, Germany’s energy consumption fell to its lowest in decades, influenced not only by crises but also by structural trends. Looking ahead, lower energy demand growth due to population decline can facilitate the achievement of climate targets, as there is less pressure to meet ever-rising demand. Indeed, Europe’s climate scenarios count on reduced energy use (21–42% lower by 2040 than today), a trajectory made more attainable by stagnant demographics. Germany can thus focus on replacing fossil fuels with renewables, rather than expanding total energy supply. The analysis showed that the country’s sectoral energy breakdown – roughly 30% transport, 27% industry, 27% residential, 15% services – will shift in composition. By 2040, a larger slice of the energy pie will be electricity (for cars, heat pumps, industrial processes), and a much smaller slice will be fossil fuels (oil for transport and heating likely plummeting). Coal and nuclear will be virtually absent. The energy mix will have adapted: for example, wind and solar power are expected to produce the majority of Germany’s electricity by 2040, with onshore wind alone projected to add around 144 TWh by that year, making it the single largest source. Such changes are responses to policy drivers, but demographics make their implementation somewhat smoother by damping energy demand.

However, a declining population also poses economic and operational challenges for the energy sector. Infrastructure maintenance with fewer customers, potential utility revenue shortfalls, and the need for a strong workforce despite a shrinking labor pool are issues that require strategic policy responses. The article outlined numerous policy adaptations, from accelerating efficiency retrofits to rethinking infrastructure and investing in flexibility, that can help manage these challenges. The key is foresight: integrating demographic change into energy policymaking now, rather than treating it as an external factor. Germany appears to be moving in this direction – for instance, studies calling for considering population uncertainty in energy planning are influencing how plans are made.

In a broader sense, Germany’s situation exemplifies a 21st-century paradigm: mature economies may see declining energy demand in absolute terms while still improving prosperity and reducing emissions. This is a stark contrast to the 20th-century paradigm of parallel growth in population, economy, and energy use. Germany, and Europe at large, are at the forefront of this new reality. By 2040, success for Germany will be measured not by how much energy is consumed, but by how efficiently and cleanly energy is used to support a high quality of life for a smaller, older population. If the lights stay on, homes stay warm (or cool) with minimal carbon footprint, industries remain productive, and energy bills stay affordable – all with fewer people consuming – that will mark a resilient adaptation to demographic change.

Europe’s population decline is sometimes portrayed as a looming crisis, but from an energy and climate perspective, it can be part of a virtuous cycle: fewer people easing pressure on resources, buying time to transition to sustainable energy, which in turn mitigates climate change for future generations. Germany’s policies will be crucial in realizing this potential. The comparison with other European countries suggests that while each nation has unique aspects, they share common solutions in efficiency, smart infrastructure, and renewable integration. Germany can leverage its technological leadership and lessons learned domestically to aid neighbors, and vice versa.

In conclusion, the impact of Germany’s population decline on electrical and heating demand to 2040 will be significant but manageable. Total energy demand will likely contract modestly, with the residential and transport sectors leading the downward trend. Germany’s energy mix will continue shifting toward renewables, effectively adapting to a scenario of lower growth in consumption. Economic and policy measures are needed to navigate the transition to a smaller scale without stranding assets or burdening citizens. As this well-researched assessment has shown, proactive adaptation is already underway – and it must continue. Germany stands at the nexus of demographic and energy transformation; by embracing both, it can ensure that in 2040, it is a cleaner, greener country that meets the needs of its people (however many or few) sustainably. The German case thus offers a model for other aging societies charting the path to net-zero emissions in a post-growth context. Through smart planning and inclusive policies, the lights of the Energiewende will shine even as the population curve bends downward, illuminating a future where human well-being, not sheer consumption, is the metric of progress.